Open a micro letter and sweep a two-dimensional code

Subscribe to our WeChat public number

Turn on the phone and sweep the two-dimensional code

You can access the website and share it with your friends through a mobile phone

China’s current Company Law was enacted in 1993 and has undergone multiple revisions, including the revision in 2018 focusing on companies’ registered capital systems. On December 29, 2023, the Standing Committee of the 14th National People’s Congress, China’s top legislature, approved a comprehensive revision to the Company Law (“Company Law 2024”). The Company Law 2024 will come into force on July 1, 2024. It notably strengthens corporate governance, registered capital contribution, equity transfer and potential liability, directors and senior managements’ duties and liabilities. The Company Law 2024 also introduces a range of amendments to the current law, including new types of shares that companies limited by shares may issue, shareholders’ right to know, functions of capital reserve, and companies’ capital decrease and liquidation.

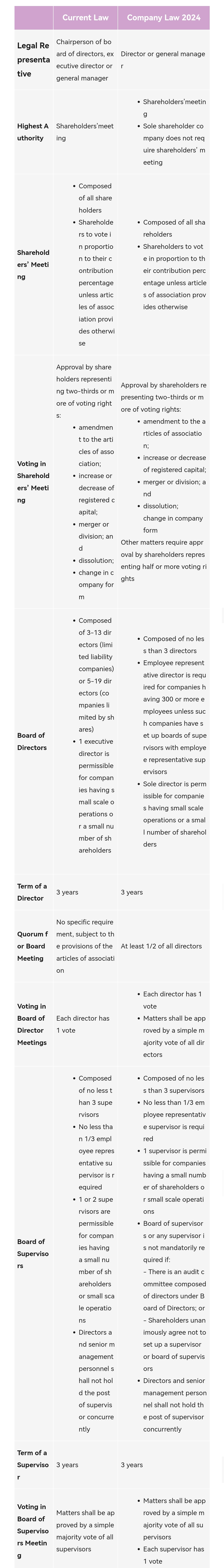

1. Corporate Governance

There are a number of changes to the corporate governance regime under the Company Law 2024. The chart below illustrates the key changes in respective of corporate governance.

2. Registered Capital Contribution

2.1 5-year contribution term

Currently an investor has the sole discretion in determining, as provided in the articles of association, the amount, form, and contribution schedule of the company’s registered capital. The Company Law 2024 provides that all shareholders shall complete their respective contributions to the registered capital of a company within 5 years after the date of incorporation, unless applicable laws or regulations require otherwise. It should be noted that in the event of increasing registered capital, the contribution to increased capital shall also meet such 5-year contribution term.

2.2 More forms of capital contribution

The Company Law 2024 for the first time makes it clear that equity and credit rights can be used for contributing the registered capital after being appraised.

2.3 Liability for failing to make capital contributions

If a shareholder of a company fails to make capital contribution to the company’s registered capital in full and on schedule, it shall be liable to compensate for losses that the company may suffer as a result, in addition to continuing to fulfil its contribution obligation, while other shareholders shall be jointly liable for such failure.

2.4 Forfeiture of equities/shares

Generally, forfeiture of equities/shares is referred to as the situation when equities or shares are cancelled due to non-payment of subscribed registered capital amount by a shareholder and in the event of forfeiture of equities/shares, the shareholder loses the rights and interests in the ownership of the equities/shares that fail to be contributed.

Under the Company Law 2024, specifically:

(1) Board of directors is obligated to check shareholders’ capital contribution status; if a shareholder fails to make capital contribution in full and on schedule, the company may serve a written notice on such shareholder requiring payment;

(2) The above notice may specify a grace period of at least 60 days to request such shareholder to fully complete the capital contribution;

(3) If the amount payable specified in the notice was not paid within the grace period, the company may, after resolution of board of directors, serve a written notice of forfeiture on such shareholder stating that any equity/share in respect of which the notice has been given is forfeited upon the date of notice;

(4) The forfeited equities/shares shall be sold, or cancelled by decreasing registered capital; if such forfeited equities/shares fail to be sold or cancelled within 6 months, other shareholders shall be liable to make capital contributions in proportion to their respective shareholding percentage.

(5) The shareholder whose equities/shares have been forfeited has the right to challenge the forfeiture by filing a lawsuit to court within 30 days after receipt of the notice of forfeiture.

3. Equity Transfer of Limited Liability Company

Currently, any equity transfer relating to a limited liability company (1) requires consent of more than half of the other shareholders and (2) is subject to a right of first refusal in favor of other shareholders.

Now the Company Law 2024 eliminates the shareholders’ consent. Accordingly, a transferring shareholder needs to only notify other shareholders in writing, so that other shareholders may decide whether or not to exercise their right of refusal and they will be deemed to have waived such right if they do not reply within 30 days.

The Company Law 2024 further provides that:

Transferee is obligated to make capital contribution to the equities that are transferred but unpaid; if transferee fails to make capital contribution in full and on schedule, transferor shall be liable for the capital contribution;

Transferee and transferor are jointly and severally liable for capital contribution if transferor fails to make capital contribution or the value of non-monetary contribution made by transferor is remarkably lower than the subscribed registered capital; transferee will not be held liable only if it is proved that it is not aware of or ought not to be aware of such circumstances.

4. Duties of Directors, Supervisors and Senior Management

4.1 Duties of loyalty and care

Directors, supervisors and senior management owe duties of loyalty and care to the company. The Company Law 2024 further defines the duties of loyalty and care.

Duty of loyalty requires directors, supervisors and senior management to take measures to avoid any conflict of interest, and not to seek improper interests by taking advantage of their powers;

Duty of care requires directors, supervisors and senior management to exercise reasonable care to ensure the best interests of companies when performing their work duties.

In particular,

Directors, supervisors and senior management shall not directly or indirectly enter into any contract or transaction with the company unless and until they report the contract or transaction to board of directors or shareholders’ meeting and board of directors or shareholders’ meeting approves the contract or the transaction in accordance with the articles of association.

Directors, supervisors and senior management shall not take advantage of their positions to seize business opportunities that belong to the company for their own benefit or the benefit of others unless and until (1) they report the business opportunities to board of directors or shareholders’ meeting and board of directors or shareholders’ meeting grant approval in accordance with the articles of association; or (2) the company is not able to utilize such business opportunities.

Directors, supervisors and senior management shall not engage in the same type of business as the company on their own or with others without approval of board of directors or shareholders’ meeting.

4.2 Personal liabilities

Under certain circumstances, directors, supervisors and senior management may be personally liable for losses of the company:

Directors, supervisors and senior management violate any provisions of the laws, the administrative regulations or the articles of association in the performance of their duties, thus causing any losses to the company;

directors or senior management, when performing their work duties, cause losses to any third party, which is determined to have resulted from their intentional act or gross negligence;

a shareholder fails to make capital contribution in full and on schedule;

a shareholder withdraws its contributed capital;

the company distributes the profits to shareholders in violation of the Company Law 2024;

the company conducts capital decrease in violation of the Company Law 2024.

5. Next Steps for Companies in China

5.1 Although the Company Law 2024 has not yet come into force, it is anticipated that it will provide greater flexibility and higher compliance for managing companies. We recommend companies review their articles of association in the context of the Company Law 2024 to take a view on what amendments are required and to consider how they can best take advantage of the new regulatory framework as contemplated by the Company Law 2024.

5.2 The Foreign Investment Law offers a 5-year transition period from January 1, 2020 to December 31, 2024 during which current foreign investment enterprises (FIEs) may keep their corporate forms established under the previous FIEs laws. FIEs who are Sino-foreign equity joint ventures and Sino-foreign cooperative joint ventures shall complete the change of their corporate forms and governance structure in accordance with the Company Law 2024, Partnership Enterprise Law and other applicable laws and regulations prior to the expiry of the transition period. Their articles of association, shareholders agreement, joint venture contracts and other related documents should be updated to reflect the new corporate forms and governance structures, while other agreements between joint venture partners in the original articles of association, joint venture contracts or shareholders agreement as to transfer of equity, distribution of profits, and distribution of remaining assets may remain unchanged and continue to be valid even after the completion of the above mentioned changes, unless joint venture partners choose to reopen the negotiation and reach new agreements.

5.3 Supervisors or board of supervisors are no longer mandatorily required. Although they are intended to achieve a check and balance within companies, in practice it may not be needed for FIEs, especially for those wholly owned foreign enterprises who are managed by overseas parent companies fully through board of directors or executive director. It is advisable for FIEs to review the necessity of having supervisors or board of directors or alternatively setting up an audit committee under board of directors and to make changes to their governance structure when needed.

5.4 The Company Law 2024 requires all the companies incorporated before July 1, 2024 to gradually adjust their capital contribution schedule in order to meet the new 5-year contribution term. But details are unclear. It is expected that the State Council will issue implementation regulations to guide the adjustment, which deserves our continuous attention.

7F Wheelock Square, 1717 Nanjing West Road, Shanghai 200040, PRC

Zip Code:200040

Phone:+8621 61132988

Fax:61132913

Email:hr@mhplawyer.com